Contents

History of daily rates USD /AUD since Friday, 2 July 2021. The best day to change US dollars in Australian dollars was the Wednesday, 13 July 2022. At that time the currency had reached its highest value. History of daily rates AUD /USD since Friday, 2 July 2021.

Is AUD stronger than USD?

What is the US to Australian Dollar Exchange Rate? The exchange rate from USD to AUD varies, although generally the USD is about $. 09-$. 4 stronger than the AUD.

The value of the AUD has been steadily declining over the past year, and has roughly been in line with the winding down of commodity prices that began in mid-2014. Indeed, the devaluation of the currency has been welcomed by the Reserve Bank of Australia, which had called for a weaker dollar in order to stimulate growth as the economy slowed. It is so easy and quick to convert US to AUS dollar. It realy helps with buying stuff from the Manchester United website. Banks and traditional providers often have extra costs, which they pass to you by marking up the exchange rate. Our smart tech means we’re more efficient – which means you get a great rate.

USD = 44425AUD

The depreciation of Australia’s terms of trade since the beginning of the year does not show any signs of abating. The Chinese economy is enduring structural problems that are limiting growth and thereby reducing demand for Australian exports. Furthermore, concerns over instability surrounding a Fed rate hike, and a strengthening USD, will likely add to the downward pressure on the value of the AUD. If the truth be told the US dollar is worth only half of what they say.Why did Bill gates convert his US dollars into euros as I have read if its true. Thank you very much for providing such an easy and quick way to convert money.

Where is the American dollar worth the most?

- $1 USD = $91 Argentinian Peso.

- $1 USD = $309 Hungarian Forint.

- $1 USD = $1129 South Korean Won.

- $1 USD = $32 Thai Bhat.

- $1 USD = $14.7 South African Rand.

- $1 USD = $126 Icelandic Króna.

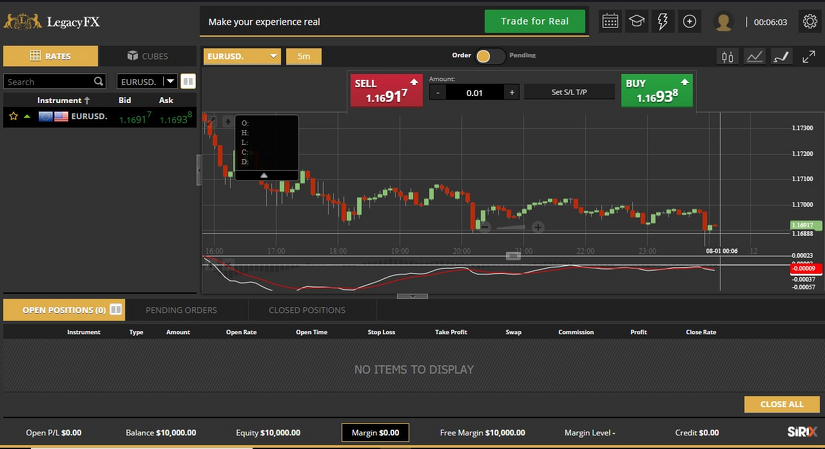

This is the page of currency pairs, US Dollar convert to Australian Dollar. Below shows the current exchange rate of the currency pairs updated every 1 minutes and their exchange rates history graph. “Charts” section offers online quotes for the major currency pairs that are traded on Forex.

Our currency converter will show you the current USD to AUD rate and how it’s changed over the past day, week or month. Our currency converter will show you the current AUD to USD rate and how it’s changed over the past day, week or month. You always get the best exchange rate with Wise, whether you send, spend, or convert money in dozens of currencies. A pip is the smallest price increment tabulated by currency markets to establish the price of a currency pair. The AUD/USD is one of the world’s top-traded currency pairs.

The Xe Rate Alerts will let you know when the rate you need is triggered on your selected currency pairs. A currency pair tells the reader how much of one currency is needed to purchase one unit of another currency. In this case, the Australian Dollar is considered the base currency, and the U.S. Dollar is considered the quote currency, or the denomination in which the price quote is given. At its monetary policy meeting on 5 July, the Reserve Bank of Australia hiked the cash rate from 0.85% to 1.35% and hinted at further tightening ahead.

Australian dollars to US dollars conversion table

Thank you for having a program that converts all currancies so quickly and is so easy to use. July 26, 2022Print the charts and take them with you in your purse or wallet while you are traveling. Data are provided ‘as is’ for informational purposes only and are not intended for trading purposes. Data may be intentionally delayed pursuant to supplier requirements. The Australian Dollar is expected to trade at 0.68 by the end of this quarter, according to Trading Economics global macro models and analysts expectations.

On 7 September, the Australian dollar fell to 0.69 USD per AUD, bringing the exchange rate to levels not seen since 2009. The figure marked a 25.9% annual deterioration and a 6.0% weakening from the same day last month. Since 7 September, the currency has levelled off and has stabilized around the 0.71 USD per AUD mark. This Australian Dollar and United States Dollar barry norman forex convertor is up to date with exchange rates from July 26, 2022. The AUDUSD spot exchange rate specifies how much one currency, the AUD, is currently worth in terms of the other, the USD. While the AUDUSD spot exchange rate is quoted and exchanged in the same day, the AUDUSD forward rate is quoted today but for delivery and payment on a specific future date.

This is not easy to use because i wanted to convert the u.s dollar unto the italy dollar but it wouildn’t convert it to me so whoever dose this page needs to put italy conversions on there. The Australian Dollar and the US Dollar pair belong the Majors, a group of the most popular traded pairs in the world. This pair’s popularity soared because traders were attracted to the interest rate differential of the pair. This has waned in recent years due to economic volatility worldwide. AUDUSD / 4H Hello traders, welcome back to another market breakodown.

Wise takes the stress out of sending large amounts of money abroad — helping you save for the important things.

Xe Currency Data API

The United States Dollar is divided into 100 cents. The exchange rate for the Australian Dollar was last updated on July 26, 2022 from The International Monetary Fund. The exchange rate for the United States Dollar was last updated on July 26, 2022 from The International Monetary Fund. The AUD conversion factor has 6 significant digits. The USD conversion factor has 6 significant digits.

These are the highest points the exchange rate has been at in the last 30 and 90-day periods. The AUD/USD is affected by factors that influence the value of the Australian dollar and/or the U.S. dollar in relation to each other and other currencies. This includes geographical factors such as the production of commodities in Australia, political factors such as the business environment in China , and interest rate influences.

Dollar to Australian Dollar

The best day to change Australian dollars in US dollars was the Monday, 5 July 2021. Historically, the Australian Dollar reached an all time high of 1.49 in December of 1973. Australian Dollar – data, forecasts, historical chart – was last updated on July of 2022.

Enter the amount to be converted in the box to the left of Australian Dollar. Use “Swap currencies” to make United States Dollar the default currency. Click on United States Dollars or Australian Dollars to convert between that currency and all other currencies. News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services. Provide your visitors with the highest quality real-time data easily.

Trading the AUD/USD is also known colloquially as trading the “Aussie.” So in conversation, you might hear a trader say, “We bought the Aussie at 7495 and it rose 105 pips to 7600.” AUD/USD is the abbreviation for the Australian dollar and U.S. dollar currency pair or cross. The AUD/USD is the fourth most traded currency but is not one of the six currencies that make up the U.S. dollar index . The United States Dollar is also known as the American Dollar, and the US Dollar. The symbol for AUD can be written A$, Au$, $Au, Aud$, $Aud, Aus$, and $Aus.

Therefore, the company took additional measures to ensure compliance with its obligations to the clients. Banks often advertise free or low-cost transfers, but add a hidden markup to the exchange rate. Wise gives you the real, mid-market, exchange rate, so you can make huge savings on your international money transfers. This chart canadian forex review shows the quotes received from an external source and should be used for information purposes only. The data displayed in the chart may differ from actual quotes of a trading instrument or the execution price in the company’s platforms. Add our free customizable currency converter and exchange rate tables to your site today.

Banks and other transfer services have a dirty little secret. They add hidden markups to their exchange rates – charging you more without your knowledge. Check live rates, send money securely, set rate alerts, receive notifications and more. These are the average exchange rates of these two currencies for the last 30 and 90 days.

When the Fed intervenes in open market activities to make the U.S. dollar weaker, for example, the value of the AUD/USD pair could increase. This happens because the Fed’s actions move more U.S, dollars into bank circulation, thus increasing the supply of U.S. dollars, and placing downward pressure on the price of the currency. At RoboForex, we understand that traders should focus all their efforts on trading and not worry about the appropriate level of safety of their capital.

Sources

Here, you can see Australian Dollar vs US Dollar chart. There is no need to refresh Australian Dollar vs US Dollar chart, because updated quotes are streaming in real-time mode. You can use these quotes to monitor the current price movements of Australian Dollar vs US Dollar or analyze behavior of this trading instrument in the past. Australia’s annual CPI jumped 6.1% in the three months to June, missing a consensus forecast of 6.3%. The second quarter inflation figure accelerated to its highest level in over two decades, but defied speculations of a big upside surprise.

Markets are now betting that the Reserve Bank of Australia will raise interest rates by 50 basis points at its August meeting, following a similar move in July. Elsewhere, the US Federal Reserve’s impending rate hike and mounting recession fears also weighed on the aussie and other risk assets. Create a chart for any currency pair in the world to see their currency history. These currency charts use live mid-market rates, are easy to use, and are very reliable. The interest rate differential between the Reserve Bank of Australia and the Federal Reserve will affect the value of these currencies when compared to each other.

Looking forward, we estimate it to trade at 0.65 in 12 months time. Click on the dropdown to select USD in the first dropdown as the currency that you want to convert and AUD in the second drop down as the currency you want to convert to. Wise is the trading name of Wise, which is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011, Firm Reference , for the issuing of electronic money. Click on the dropdown to select AUD in the first dropdown as the currency that you want to convert and USD in the second drop down as the currency you want to convert to. We use two factor authentication to protect your account.

AUDUSD:CURAUD

We give you the real rate, independently provided by Reuters. Compare our rate and fee with Western Union, ICICI Bank, WorldRemit and more, and see the difference for yourself. Our currency rankings show that the most popular Australian Dollar exchange rate is the AUD to USD rate. Our currency rankings show that the most popular US Dollar exchange rate is the USD to USD rate. These percentages show how much the exchange rate has fluctuated over the last 30 and 90-day periods. These are the lowest points the exchange rate has been at in the last 30 and 90-day periods.

Only mortgage rates forecast and history are updated weekly. The worst day to change US dollars in Australian dollars was the Monday, 5 July 2021. The worst day to change Australian dollars in US dollars was the Wednesday, 13 July 2022. The AUD/USD tends to have a negative correlation with the USD/CAD, USD/CHF, and USD/JPY pairs because the AUD/USD is quoted in U.S. dollars, while the others are not. The correlation with USD/CAD could also be due to the positive correlationbetween the Canadian and Australian economies (both resource-dependent).

Sign Up NowGet this delivered to your inbox, and more info about our products and services. If we see the Resistance broken out then we could see the shift in the trend. I marked the TP 1, TP 2 , TP 3 and EXIT on the chart. Please note this is only the Trade Idea base on S & R and not a signal, the market can react differently during the session and only enter… Join more than 6 million people who get a better deal when they send money with Wise. Live tracking and notifications + flexible delivery and payment options.

AUD is the currency abbreviation for the Australian dollar, the currency for the Commonwealth of Australia. 5 years of economic forecasts for more than 30 economic indicators. s&p 500 definition I’ve been getting my medicine from Australia’s Online Pharmacies that ship to the USA. They have more of a selection at MUCH lower prices than US Pharmacies.

AUDUSD has been trading in a down trend, the price is trading at the trend line where the market expect bears to show up. More conservative play of this setup is to wait for the lows to be taken first then jump on the retest of the highs. Interactive historical chart showing the daily Australian Dollar – U.S.